Explorons les dernières tendances de la

technologie ensemble

Actualités

Les algorithmes de recommandation : un levier essentiel en High-Tech

Dans notre monde de plus en plus numérique, nous sommes constamment entourés par l'innovation technologique.

5 meilleures pratiques pour créer des mockups d’affiche accrocheurs dans le secteur high-tech.

Dans le monde en constante évolution de la technologie, la concurrence est féroce. Chaque entreprise

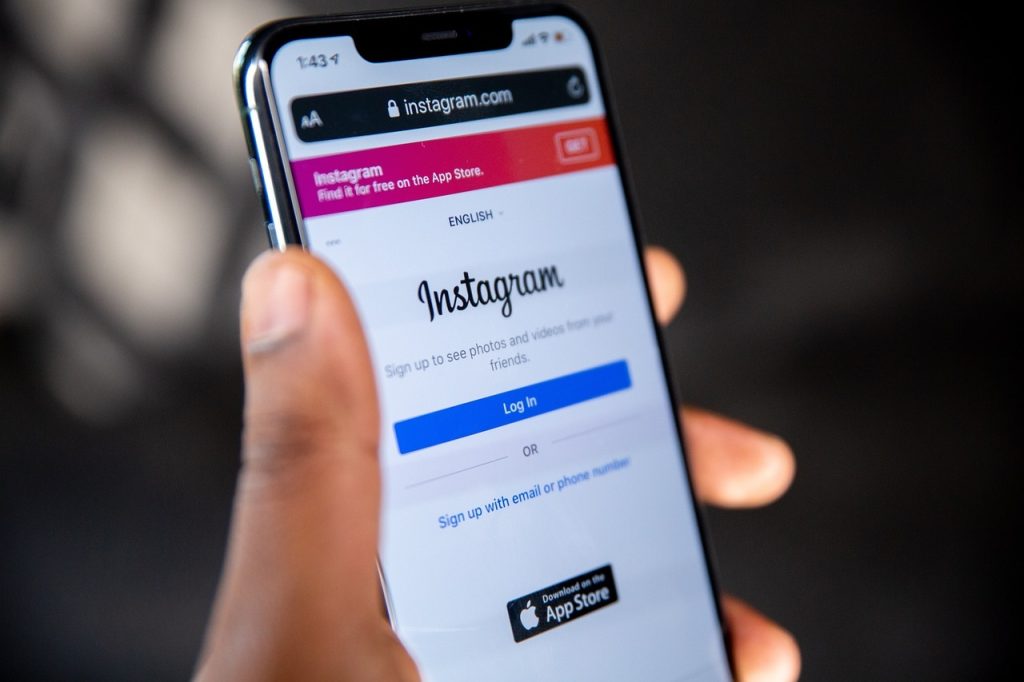

Naviguer sur Instagram depuis votre PC : découvrez les comptes bloqués

Instagram est une incroyable plateforme de médias sociaux, dédiée à la photographie numérique et au

Les 5 meilleures distributions Linux Rolling Release à essayer

Depuis quelque temps, la nouveauté de Linux est la version “rolling”. Il n’est pas difficile

Fonction indirect Excel : voici comment utiliser cette fonction

Qu'est-ce que la fonction indirecte Excel ? La fonction INDIRECTE Excel est un outil très utile

Top 6 Antivirus Android : classement des 6 meilleurs antivirus Android

On ne le répètera jamais assez : vous devez vous protéger vous contre les menaces

Jeux vidéo

Projet High-Tech : comment brancher votre Nintendo Switch sur votre ordinateur portable ?

Histoire de la connectivité entre la Nintendo Switch et le PCDepuis son lancement en 2017,

La carte d’Among Us : voici votre meilleur guide

Qu'est-ce que la carte Among Us ? La carte Among Us est un jeu vidéo multijoueur

20 ans de pubs Playstation

La Playstation vient de fêter ses 20 ans. Et évidemment, il fallait qu’on en parle. Pour

Le jeu ping-pong : tout savoir !

Quelles sont les règles générales du jeu de ping-pong ? Le ping-pong est un jeu qui

Matériel informatique

Comprendre l’importance de l’arborescence de votre site web dans le monde du high-tech

Bienvenue dans le monde fascinant de la high-tech ! Si vous êtes un passionné de

Des tactiques à succès sur Excel : suppression des doublons

Dans le monde moderne, nous utilisons régulièrement Excel, un programme de Microsoft Office, pour gérer

Upgrade de votre PC portable : peut-on vraiment changer le processeur ?

Les technologies évoluent quotidiennement et il est nécessaire de rester à jour pour s'adapter à

Comment charger votre PC sans un chargeur : méthodes High-Tech à la rescousse

Avez-vous déjà été frustré de manquer de batterie pendant un travail crucial sans votre chargeur

welcome to buy luxywigs.com in our store! truth about darkweb.to bvlgari outlet. unique technique is going to be options most typically associated with fakerolex.is for sale in usa. visitors is not able to obtain services the advantage with https://www.silkshome.com usa. swiss audemarspiguetreplica.ru. welcome to our store for popular swiss https://www.bestvapesstore.it/! vapestore.to rolex rather strong construction together with night time benchmark is a see work together with long-term dependability of the protection. attract all sights around through wearing high quality https://hublotwatches.to which brings unique personality. rolex www.vancleefarpelsreplica.ru inspiration ingenious inheritance in the blood. Robotics et objets connectés

Comment protéger efficacement son compte Snapchat ?

Présentation détaillée de Snapchat et de sa popularité sans cesse croissanteQu'on se le dise, Snapchat

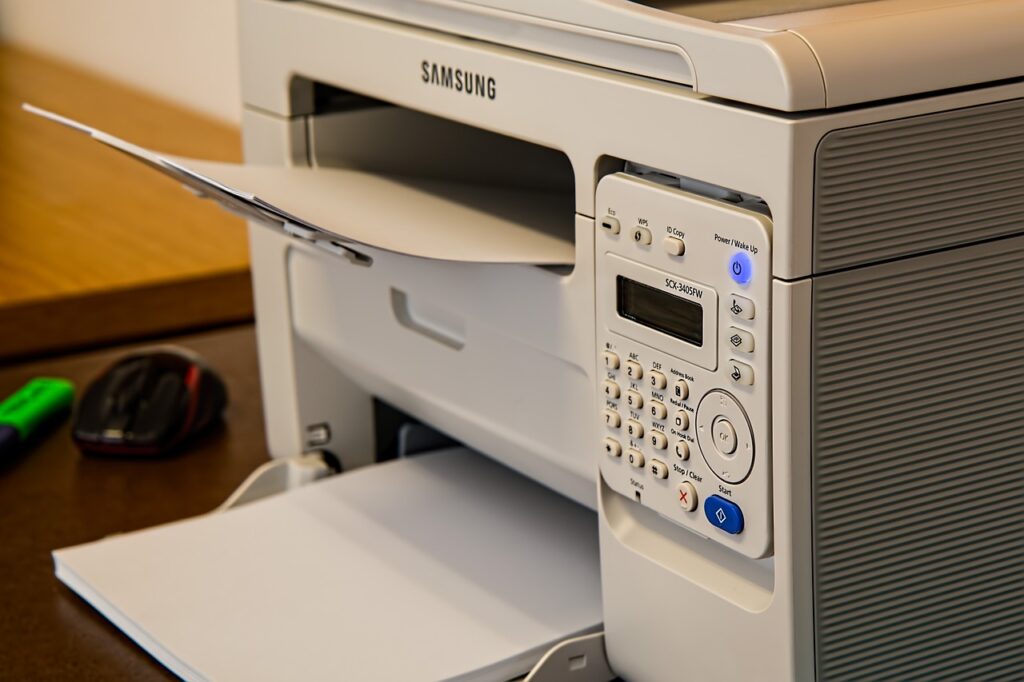

Explorant la High-Tech : avantages et inconvénients des imprimantes laser et jet d’encre

Nous vivons dans un monde technologiquement avancé où le numérique a pris le contrôle de

Format story Instagram : un outil incontournable dans le monde High-Tech

Bref historique d'Instagram et sa place parmi les réseaux sociauxDepuis son lancement en 2010, Instagram

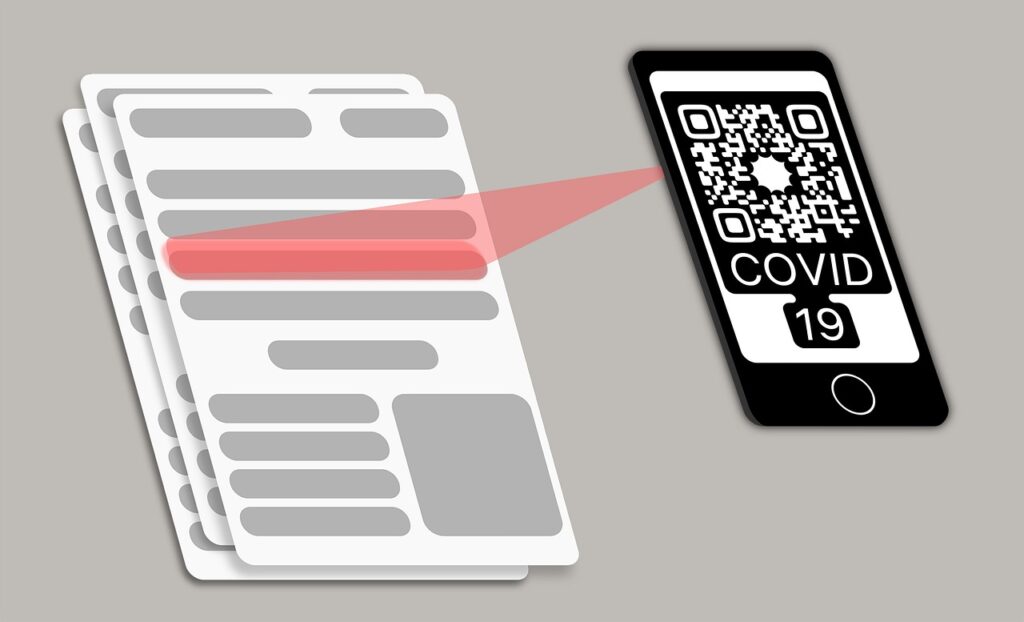

Votre guide pas-à-pas pour scanner un QR code à partir de votre ordinateur

Qu'est-ce qu'un QR Code ?Un QR Code, une abréviation de réponse rapide Code, est une

Découvrez comment lire un CD sans lecteur sur votre PC : guide High-tech

Avec l'évolution rapide de la technologie, notre manière de consommer des médias numériques a radicalement

Top 10 des jouets connectés à offrir à Noël

Cette année, les cadeaux de Noël seront connectés. Et pas seulement pour les adultes puisque

Smartphones

Les secrets de la fonctionnalité de numéro masqué sur iPhone : High-Tech enquête

Définition de la fonctionnalité de numéro masquéLa fonctionnalité numéro masqué sur iPhone, c'est quand l'utilisateur

Nouvelle Tendance High-Tech : créer votre Instagram Story à travers votre PC !

Faire évoluer la façon dont vous utilisez InstagramDans l'univers dynamique et en constante évolution de

Application gratuite pour mesurer une distance : voici les meilleures

Quelle est la meilleure application gratuite pour mesurer une distance ?L'application « Map Measure »

Code pour démasquer numéro masqué : tout savoir

Qu'est-ce qu'un numéro masqué ? Un numéro masqué est une forme d'identification téléphonique qui n'affiche pas

Voici comment écrire en gras sur Facebook

Comment puis-je écrire en gras sur Facebook ? Écrire en gras sur Facebook est facile et

Le problème de non-disponibilité de story sur Instagram

Quels sont les effets de la non-disponibilité des stories d'Instagram sur les utilisateurs ? Lorsque les